Employee retention tax credit calculator

So 50000 in Q3 50000 in Q4 2021. Because you used the Coronavirus Job Retention Scheme to put them on furlough use what they would have earned normally when.

1 Trillion Infrastructure Law Ends Employee Retention Tax Credit Fsr Magazine

IT-648 Fill-in IT-648-I Instructions Life Sciences Research and.

. About Publication 972 Child Tax Credit. Statutory Bonus The bonus is generally 833 of the employees salary and the maximum statutory bonus that is allowed is 20 of the employees salary. Eligible wages per employee max out at 10000 so the maximum credit for eligible wages paid to any employee during 2020 is 5000.

In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption. IT-647-ATT Fill-in IT-647-I Instructions Eligible Farm Employee Information for the Farm Workforce Retention Credit - Attachment to Form IT-647. Non-Refundable Employee Retention Tax Credit.

Since it only covers 50 of wages per employee this gives employers a total credit of up to 5000 for each employee they retain. How to Calculate Net Revenue Retention NRR Net revenue retention NRR also known as net dollar retention NDR is a crucial key performance indicator KPI for SaaS and subscription-based companies. Employee benefits administration means determining and managing of benefits offered to the employees at a company.

Understand the rules to qualify for the Employee Retention Tax Credit including an easy-to-follow flow chart illustrating the 2020 and 2021 rules including the extension to Q3. To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns lateThe IRS is also taking an additional step to help those who paid these penalties already. Employee Training Incentive Program Tax Credit.

The Employee Retention Tax Credit is a refundable payroll tax credit designed to encourage employers whose companies were disrupted by COVID-19 restrictions to retain employees and keep them on. Only a non-refundable tax credit may make a taxpayers liability disappear. The Employee Retention Credit ERC was created by the federal government to help ease the financial hardship caused by the COVID-19 pandemic on small businesses.

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. A retention strategy is a plan that organizations create and use to reduce employee turnover prevent attrition increase retention and foster employee engagement. NRR is of particular importance in the SaaS industry because it is not only a measure of customer retention but also a companys ability to maintain high engagement and.

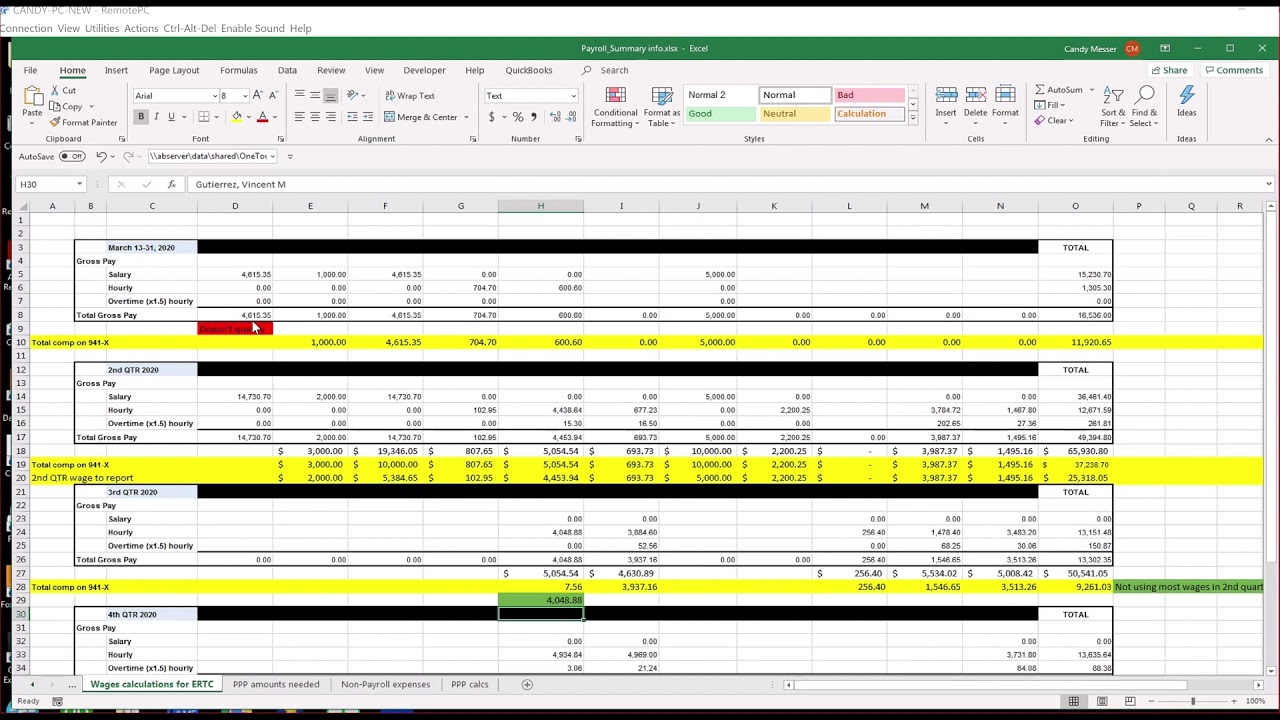

The credit applies to wages paid after March 12 2020 and before January 1 2021. The IRS published Worksheet 1 to help companies figure out their tax credits. Employer calculator - calculate your employees statutory.

Employee Retention Credit Calculator. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below. So the good news here is your startup can save basically 7000 per employee on a tax credit assuming they pay at least 10000 or more to that employee in the eligible time periods.

Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. Lastly for the employee retention credit you will need to gather any sales revenue from 2019-2020. If you do not have a business with 100 or fewer workers then this part does not apply to you.

Provident Fund It is a deduction that every employer needs to deduct as per government law. For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter. IT-647 Fill-in IT-647-I Instructions Farm Workforce Retention Credit.

The ERC is a refundable payroll tax credit for wages and health plan expenses paid or incurred by an employer whose operations were either fully or partially suspended due to a COVID-19. But once you determine that youre. Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns.

The Employee Retention Credit ERC is a tax credit first put in place last year as a temporary coronavirus-relief provision to assist businesses in keeping employees on payroll. The taxpayer automatically forfeits any leftover credit amount. This ERTC calculator will help you.

Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Determine which quarters you qualify for the tax credit based on gross receipts as well as when you no longer qualify. The time frame for the credit is any wages earned between March 12 2020 and Jan.

Its merely a calculator to assist you in 2021 with your Form 941. While some turnover is inevitable building a retention strategy to prevent as much voluntary turnover as possible can save an organization a lot of time and money. Employers who are eligible for ERC can receive tax credits in exchange for qualified wages and health plan expenses paid to and on behalf of employees.

Its capped at 50000 per quarter. Since then the. For the purposes of the employee retention credit the order is considered to have a more than nominal impact if.

Benefit administration systems generally determine which benefits employees qualify for including health dental disability retirement accounts and 401K vacations and paid time off sick leave and parental leave. Income Tax Income tax is deductible as per the income tax slabs prevailing. The Employee Retention Credit ERC has proven to be one of the most effective tax policies in helping small and medium businesses and tax-exempt entities weather the economic impact of the pandemic.

The amount of the retention credit calculation is determined by your net income or your loss as well as how many full-time employees you have. The Employee Retention Tax Credit can be applied to 10000 in wages per employee.

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

2

Employee Retention Credit Spreadsheet Youtube

2

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Determining What Wages To Use For The Ertc And Ppp Youtube

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Employee Retention Credit Calculation How To Calculate Recognize

Employee Retention Credit Erc Calculator Gusto

Calculating Your Employee Retention Credit In 2022

A Guide To Understand Employee Retention Credit Calculation Spreadsheet 2021 Disasterloanadvisors Com

Employee Retention Credit Erc Calculator Gusto

Calculating Your Employee Retention Credit In 2022

Employee Retention Tax Credits Could Create Significant Cash Flow For Businesses Boyer Ritter Llc

Qualifying For Employee Retention Credit Erc Gusto

Determining What Wages To Use For The Ertc And Ppp Youtube

Employee Retention Tax Credit Calculator Krost