Options strike price calculator

Risk Free Rate pa. Simply enter any brokerage fees you will have for buying or selling options contracts.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Share price at the end of the term NOY years A CSP 1SGW100NOY Average strike.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

. Ad Power Your Trading with thinkorswim. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Strike price is one of the six inputs required for option price calculation under the Black-Scholes model the others are underlying price volatility interest rate dividend yield and time to.

Three Cutting-Edge Platforms Built For Traders. With the SAMCO Option Fair Value Calculator calculate the fair value of call options and put options. Ad Learn how VIX options and futures could provide unique portfolio diversification.

The option premium in general terms for a call option will be lower the farther the strike price is above the underlying price. Lowest costs for low high frequency options traders. That is an option with a strike price of 150 will have a much.

Build Your Future With a Firm that has 85 Years of Investment Experience. Option value calculator Calculate your options value. It means that the strike price is essential in determining an options moneyness and is a necessary component for calculating the break-even point and profit or loss for all options.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Calculate the value of a call or put option or multi-option strategies. This is calculated as the 60 stock price minus the 50 option strike price minus the 3 purchase price times 100 because each options contract covers 100 shares of the.

In Table 3 it has an intrinsic value of 180 ie the strike price of 29 less the stock price of 2720 and the time value of 039 ie the put price of 219 less the intrinsic. Total Costs - Your total costs or investments that you paid for the option contracts. The option calculator uses a mathematical formula called the Black-Scholes to predict and.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Ad Were all about helping you get more from your money.

The strike price is a threshold to determine the intrinsic value of options. With this input the stock. See visualisations of a strategys return on investment by possible future stock prices.

My Free Options Strike Price Calculator. The algorithm behind this stock options calculator applies the formulas explained below. Ad The How to guide on trading options and the 5 laws of options you must obey.

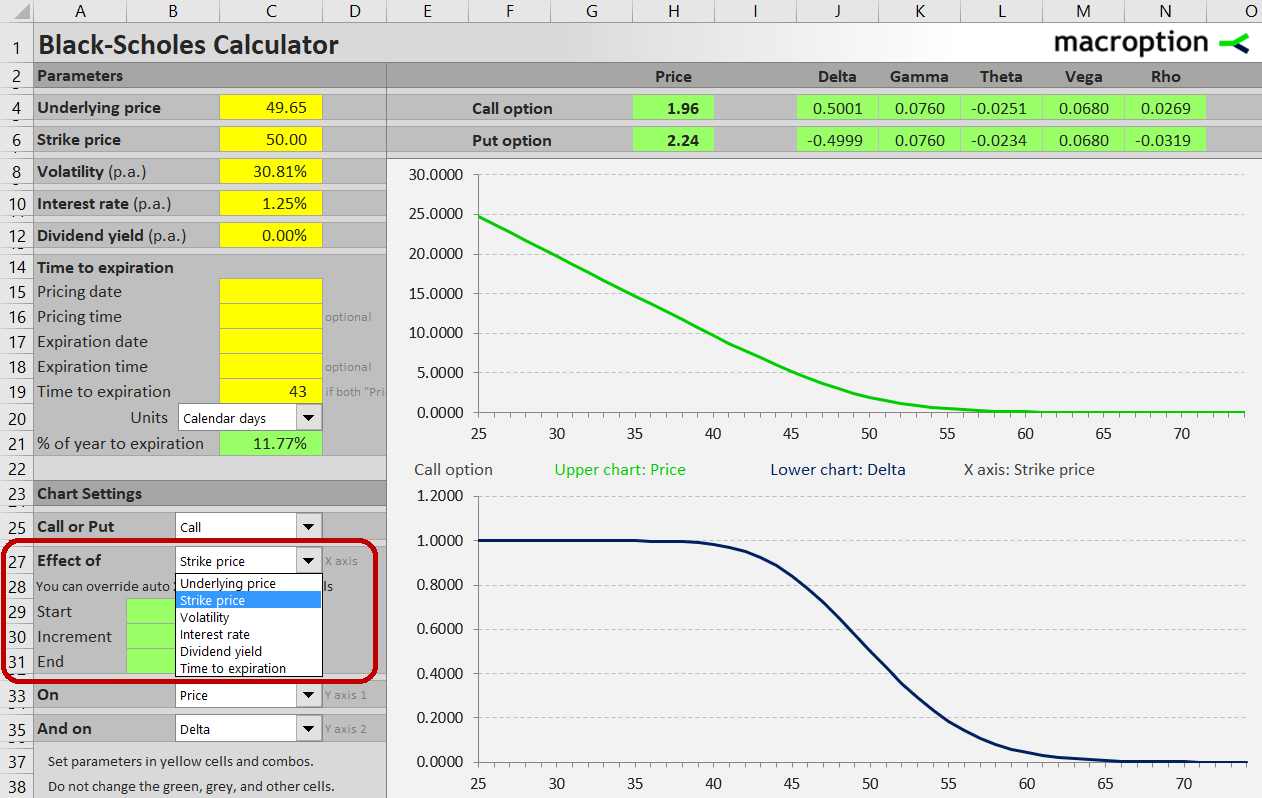

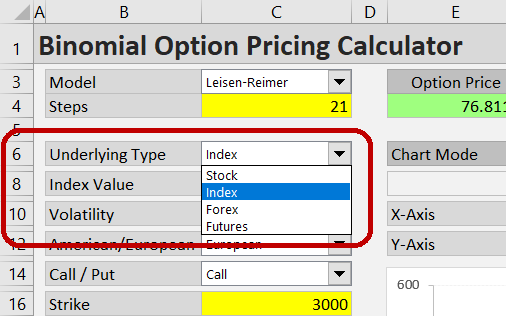

Generate fair value prices and Greeks for any of CME Groups options on futures contracts or price up a generic option with our universal calculator. It is an Excel. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0.

NSE Options Calculator - Calculate NSE Option Price or implied volatility for known option price. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. This tool can be used by traders while trading index options Nifty options or stock.

Options Status - Your options can be in three states in the money out of the money or at the money. In order to help options traders I have a developed a quick method to calculate the strike price for any stock. Ad With over 40 years experience in options trading we have a robust set of tools.

This free guide contains an easy 3 step process to trade options in todays market. Lets get started today. Option Calculator Black Scholes model Option Greeks Nifty Trader ADANIPORTS 8364 016 APOLLOHOSP 42515 086 ASIANPAINT 334325 059 AXISBANK 7287 217.

To calculate the implied volatility of a EUROPEAN CALL option enter all of its parameters above the volatility field will be ignored and enter the price below. Free stock-option profit calculation tool. Multiply the strike price by 100 to calculate the additional amount youll pay to use the option to buy or sell stock.

Concluding the example multiply 35 by 100 to get 3500. The fees field is pretty straightforward. Underlying Volatility Market Price of Option.

Options involve risk and are not suitable for all investors. Build Your Future With a Firm that has 85 Years of Investment Experience. Customize your input parameters by.

On this page is an Incentive Stock Options or ISO calculator.

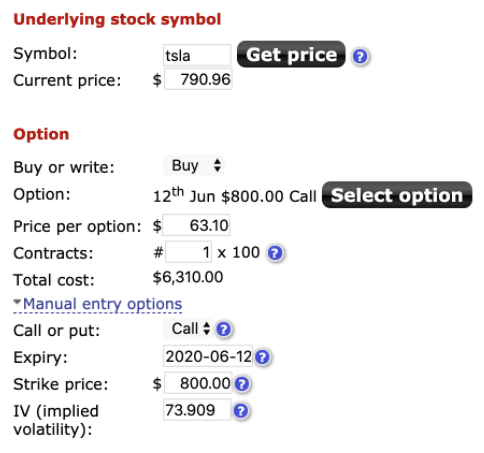

Option Premium Calculator Streamlined And Easy To Use

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Options Profit Calculator Updating An Estimate For An Existing Calculation On Options Profit Calculator

Working With Strike Price In The Black Scholes Calculator Macroption

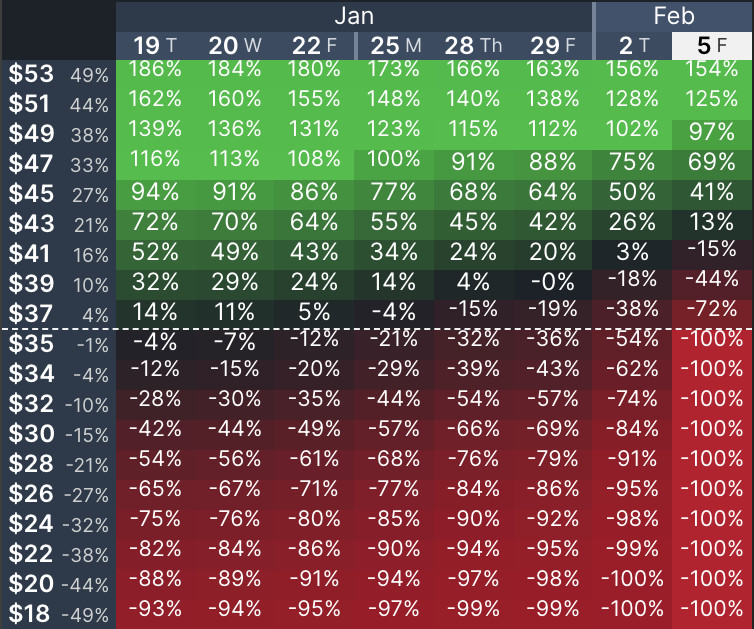

Probability Of A Successful Option Trade

Index Options Binomial Option Pricing Calculator Macroption

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

The Options Industry Council Oic Options Pricing

Pricing Options Strike Premium And Pricing Factors Nasdaq

Option Price Calculator Calculate Bs Option Price Greeks

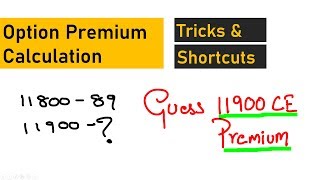

Option Premium Calculation Simplified Try This Shortcut Trick To Find Delta Eqsis Youtube

Ivolatility Com Services Tools Analysis Services Basic Live Calculator Live Calculator

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Call Option Calculator Put Option

Using Optionstrat S Options Profit Calculator Optionstrat

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Calculating Call And Put Option Payoff In Excel Macroption